The investors who plan to invest more and maximize their profit rate are now shifting their focus to the real estate market of Dubai. Calling for endless growth opportunities, this city boosts the property business and makes it a profitable venture for every investor and entrepreneur. However, when it comes to rental income, one must evaluate before deciding whether one should opt for short-term vs long-term rentals.

If you are a property owner who wishes to generate revenue, both rental plans have distinctive advantages. Closely compare both options and how much money each brings to the table. This is your excellent chance to build your business in the biggest Emirate, especially when tourism is skyrocketing and expat communities are growing. Follow this guide to break down the mystery and understand all the details. Get ready to make a wiser investment decision with ease.

Dubai Real Estate in 2026: The Ultimate Investment Playground

Dubai has become a haven for property investors, especially recently. The economy of Dubai is strong with consistent visionary urban developments and high rental yields. All these factors contribute significantly to the success of both short-term and long-term rental strategies.

However, understand the process of how to sell property in Dubai. It is mandatory in both cases of renting your property short-term and long-term. Selling your property is only considered when you plan to cash out your investment right away. The process of buying and selling properties in Dubai is simplified and investor-friendly.

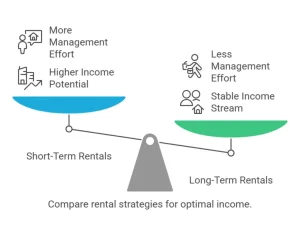

Short-Term vs. Long-Term Rentals: A Side-by-Side Comparison

Before choosing the right options, investors must compare the pros and cons of each rental strategy. Analyze the key factors mentioned below that contribute to the profitability.

| Feature | Short-Term Rentals | Long-Term Rentals |

| Profit Potential | Higher daily rates but seasonal fluctuations | Steady income with long-term stability |

| Occupancy Rate | Dependent on tourism and events | Consistent occupancy year-round |

| Management Effort | Requires frequent guest turnover and maintenance | Minimal effort after tenant move-in |

| Legal Requirements | Need a holiday home permit | Standard rental contracts |

| Flexibility | Can use the property for personal stays | Locked into lease agreements |

| Tenant Profile | Tourists, business travelers | Expats, families, professionals |

Short-Term Rentals: A High-Reward, High-Effort Strategy

Short-term rentals are in high demand with the increasing number of travelers and digital nomads in the city. Being a global tourism and business hub, the rental option in this city offers high returns.

Benefits of Short-Term Rentals

- Higher nightly rates

A well-furnished apartment in Dubai Marina can fetch up to AED 800 per night, compared to a long-term rental of AED 12,000 per month.

- Personal flexibility

Owners can block out dates for their use, making it ideal for those who visit Dubai occasionally.

- Targeting different audiences

Tourists, business travelers, and digital nomads prefer short-term stays over hotels.

- Seasonal high demand

During peak seasons such as Expo events, New Year celebrations, and global conferences, short-term rentals can be fully booked at premium prices.

Challenges of Short-Term Rentals

- Fluctuating demand

Seasonal peaks and off-seasons can impact earnings.

- Higher maintenance costs

Frequent guest turnovers mean more wear and tear.

- More management required

Booking management, check-ins, and cleaning require professional assistance.

- Legal regulations

Short-term rentals require a holiday home license, which needs renewal.

Long-Term Rentals: A Safe and Steady Income Stream

The property owners prioritize their peace of mind and prefer to invest in the long term. Long-term rentals offer reliable tenants and consistent income. Investors looking for financial stability find it a suitable option without the hassles of frequent tenant turnover.

Why Investors Prefer Long-Term Rentals

Long-term rentals offer a lot of perks, including stable rental income, less frequent vacancies, and reduced maintenance efforts. These aspects make this option a preferred choice for property owners and investors.

- Steady income: A fixed rental agreement ensures monthly payments without gaps.

- Lower management hassles: No need for constant check-ins and cleanings.

- Tenant retention: Expats make up the few to no vacancies left by staying for multiple.

- Less exposure to market fluctuations: There are no significant fluctuations in long-term rental prices with seasons.

- Cost-effectiveness: the turnover is lower. Therefore, the cost of cleaning, repairs, or any furnishing replacement is reduced.

Downsides of Long-Term Rentals

While long-term rentals offer stability and consistent income, they come with certain drawbacks that investors should consider before committing to this strategy.

- Lower rental yield: Monthly rates are lower than short-term nightly rates.

- Limited flexibility: The property remains occupied for a fixed period.

- Tenant-related risks: Delayed payments and legal disputes may arise.

- Longer contract periods: While stability is a plus, some investors prefer more frequent rental adjustments to keep up with market rates.

Key Factors to Consider When Choosing Between Short-Term and Long-Term Rentals

Making the right choice depends on a variety of factors, including property location, financial objectives, and management preferences.

Location Matters

Different locations demand and give preference to different rental plans. For instance, Tourist hotspots like Downtown Dubai and Palm Jumeirah favor short-term rentals. On the contrary, Suburban areas like Dubai Silicon Oasis and JVC are ideal for long-term rentals.

Financial Goals

Short-term rentals generate high returns quickly and substantial revenue in peak seasons. Whereas long-term rentals come with consistent income and financial stability in the long run. The market fluctuations are also less.

Management Preferences

- Short-term rentals require constant attention, marketing, and guest handling.

- Long-term rentals demand minimal intervention once a lease agreement is signed.

Which Rental Strategy Wins in 2026?

Investors need to stay updated with the evolving Dubai rental market. Keeping up with the trends enables them to maximize their profits. Short-term rentals come with higher returns. On the contrary, long-term rentals consume less effort with financial security.

The Latest Trends to Watch

- AI-powered property management is simplifying short-term rental operations.

- Flexible lease agreements are gaining popularity in the long-term rental market.

- Dubai’s smart city initiatives are enhancing real estate value across both segments.

- New tourism policies are expected to boost short-term rental demand in the coming years.

How to Sell Property in Dubai for Maximum Returns

Every individual who wishes to capitalize on their property investments must understand how to sell property in Dubai. The process includes legal paperwork, RERA compliance, and strategic pricing. Listing your property on leading platforms, networking with agents, and targeting cash house buyers can speed up the selling process. A well-prepared strategy can help you close deals quickly and maximize profits.

Snapsale: The Smart Way to Buy and Sell Properties in Dubai

If you ever plan to sell instead of renting, consider Snapsale as your one-stop solution. The professional team of Snapsale connects with the right buyers to sell your property with a smooth process. Your property instantly stands out in the market, whether you’re looking for a cash house buyer or want to list your property. With us by your side, experience a quick and rewarding venture of selling property along with leveraging competitive pricing and expert insights.

Why Choose Snapsale?

- Skip the hassle of waiting and get genuine leads instantly with Instant Buyer Connections.

- Ensure you get the best value for your property with Market-driven pricing insights.

- From paperwork to payment, enjoy Hassle-free transactions with Snapsale’s simplified process.

Final Verdict: Whether you go for short-term or long-term rentals, Dubai remains a goldmine for real estate investors. Make a choice based on your risk appetite, management capacity, and financial goals, and if you ever need to sell, Snapsale has your back!

FAQs

Q1. Specify the main difference between Dubai short-term and long-term rentals.

In Dubai, long-term rentals lock tenants for months/years with steady income. Rentals on a short-term run on daily or weekly rates.

Q2. Do I need a license for short-term rentals in Dubai?

Short-term rentals require a holiday home permit from DDT. While long-term rentals only need standard tenancy contracts registered with Ejari.

Q3. How do utilities and maintenance costs differ between the two rental types?

Short-term rentals include utilities and frequent cleaning. It makes them costlier to manage. Long-term rentals shift most utility and minor maintenance costs to tenants. This reduces owner expenses.

Q4. Which rental option is better in terms of pricing?

Long-term rentals are better in pricing. It involves fewer turnovers, lower maintenance costs, and consistent income. Rentals on short-term fluctuate with seasons and demand.

Q5. What are the pros of short-term rentals for investors?

Short-term rentals offer higher nightly rates, personal flexibility, and huge income potential. Especially during Dubai’s tourism peaks like the New Year and global events.