The property market in Dubai is packed with potential for high returns. But first, you need to know what you are doing. This means understanding your property’s actual value. Being able to estimate the potential return on your investment can help you with this, too.

Our blog post today shares the best way to sell property in Dubai. The major takeaway pointers include:

- What’s the property value?

- Is property value influenced by factors?

- What even is ROI?

- Which one would we pick as the best way to sell your property in Dubai?

What is Property Value?

Property value is the worth of your real estate asset. It’s the amount that buyers are willing to pay and what sellers hope to cash in.

So what determines this property value in Dubai? Other than square footage and fancy amenities, the factors playing a massive role include location, demand, and market trends.

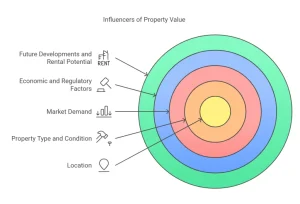

Components Influencing Property Value:

- Location: A prime address is significant in boosting your property’s value.

- Property type and condition: Newer and well-maintained properties fetch higher prices.

- Market demand – High demand equals higher prices, simple as that.

- Economic and regulatory factors – Government policies, foreign ownership rules, and economic conditions impact value.

- Future developments – Infrastructure projects and upcoming attractions can increase property demand and value.

- Rental potential – Higher rental yields make properties more attractive to investors.

- Developer reputation – Established developers with a history of quality projects influence long-term property value.

What is ROI?

A simple yet powerful metric to measure profitability based on income generated versus the cost of its investment. Return on investment is the number investors look at to determine if a property is worth their time or money.

Why Does ROI Matter?

- Helps investors compare different properties.

- Indicates whether renting or selling is more profitable.

- Provides insights for long-term investment planning.

- Highlights areas for cost optimization to improve profitability.

A high ROI could be the difference between a lucrative deal and a financial flop.

What Affects Property Value in Dubai?

There are different elements that influence Dubai’s real estate market. Here’s what you need to keep an eye on:

Location & Neighborhood

Not all areas in Dubai hold the same value. Properties in Downtown Dubai, Dubai Marina, and Palm Jumeirah will command higher prices compared to other communities. Proximity to landmarks, metro stations, and commercial hubs also adds a premium value to the price tag.

Market Trends & Economic Conditions

Dubai’s real estate is cyclical. A booming market means higher property prices, while downturns may require strategic pricing to sell efficiently. Keep an eye on supply and demand dynamics.

Government Regulations & Policies

Dubai periodically updates property laws, residency visas, and ownership regulations. Such policies can make the market more attractive for foreign investors, impacting property demand and pricing.

Amenities & Infrastructure

Properties with high-end facilities—think infinity pools, smart home features, and premium security—typically fetch higher prices. The same goes for developments near retail centers, beaches, and business districts.

Rental Yield & Investment Potential

A property’s rental potential influences its value for investors. Higher rental returns increase a property’s desirability. This makes it quite a catch as an attractive asset up for resale.

Future Development Plans

Upcoming infrastructure projects like new metro stations, malls, or business districts can drive property value up significantly. Staying updated on these developments is key to maximizing profits.

Developer Reputation

Another reason for properties having a higher value is the people behind them. High-quality projects by well-known developers tend to go on the higher side. Buyers often prefer trusted names when they are investing in real estate.

How to Assess Property Value

Accurately pricing your property attracts serious buyers. This is how you can determine its worth:

Comparative Market Analysis (CMA)

A very reliable method is comparing similar properties recently sold in your area. Look at factors like size, condition, and amenities to estimate a fair market value.

Professional Property Valuation

Hiring a licensed valuer can provide an accurate, unbiased assessment. This is especially useful when dealing with high-value properties.

Online Valuation Tools

Several platforms offer instant property value estimates based on current market data. While not as precise as professional valuation, they provide a solid starting point.

Understanding Demand Trends

Monitor real estate reports and market insights to gauge if property prices are on an upward or downward trend.

Check Developer & Project History

You can gain an edge in valuation by studying how properties by the same developers have performed over time.

How to Calculate ROI on Property Investment

To get a clear picture of how profitable your property is, you should calculate its ROI. How? The formula is simple:

ROI (%) = (Net Profit / Investment Cost) x 100

Example Calculation:

- Investment Cost here is the total amount you spent on purchasing, renovating, and maintaining your property

- Net Profit will be the income generated from rent minus expenses of mortgage, maintenance, and fees.

A high ROI means your property is performing well. Whereas a low ROI signals the need for some adjustments.

Additional ROI Considerations:

- Rental demand vs. selling opportunities.

- Long-term appreciation trends.

- Service charges and maintenance costs.

- Potential for short-term leasing for higher returns.

- Impact of seasonal market fluctuations on sale prices.

Best Practices for Maximizing ROI in Dubai

Brainstorm the Bestselling Strategy

The best way to sell property in Dubai is by adopting a strategy that reflects the market conditions. If the demand is high, no reason listing at a premium price won’t work. In slower markets, competitive pricing with added perks (like waived service fees) can attract buyers.

Enhance Property Appeal

Minor upgrades can make the biggest difference. A fresh coat of paint here, some modern fixtures there, and staged interiors can boost the perceived value.

Market Like a Pro

It won’t be right to write a blog post on the best way to sell property and not mention marketing! Professional photography, virtual tours, and engaging property descriptions can make listings look cool and catch the eyes of potential buyers. You can also increase visibility further by partnering with experienced real estate agents. They can help you market your property, too.

Understand Buyer Preferences

Know what Dubai buyers are looking for—smart home tech, sustainability features, and proximity to key attractions often top the list.

Time Your Sale Wisely

The best way to sell property in Dubai is to list when demand is high. Peak seasons, economic upturns, and favorable policy changes can all influence selling success.

Consider Leasing Before Selling

Sometimes you need to wait out the market conditions to improve. Leasing out your property for short-term rental income as you wait can be a good strategy.

FAQs

How can I check my property’s value in Dubai?

You can check your property’s value by:

- using online valuation tools

- comparing similar listings

- Getting a professional valuation from a certified real estate expert

What is a good ROI for a property in Dubai?

A good ROI depends on the location and property type.

What is the best way to sell property in Dubai quickly?

These actions can help sell your property faster:

- Price it competitively

- Market it well with high-quality photos

- Work with an experienced real estate agent

Conclusion

For making informed selling decisions, understanding property value and ROI in Dubai is quite important. You can maximize returns and close deals efficiently by analyzing market trends, accurately pricing your property, and leveraging the smart selling strategies we shared here.

The best way to sell property in Dubai? Stay informed. Market strategically. And always aim for the best possible deal.

Looking for expert guidance? Connect with our team of professionals who can assist you.