Several foreigners living in Dubai aspire to their own homes. They were only able to rent until independent properties were introduced. The cost to buy property in Dubai is becoming cheaper and gradually falling, and purchasing property in Dubai has become a realistic goal for many people.

Mortgage installments may be lower than rent in certain situations, and there is also the possibility of capital growth. However, purchasers should be aware of the extra fees connected with acquiring a house, such as those charged by the DLD, property agents or builders, financing companies, and attorneys to buy property in Dubai.

Understanding Property Costs Scenarios in Dubai

How to sell property in Dubai? Dubai’s real estate is very appealing; its grand structures and spacious villas draw investors and customers from all across the world. But first, you have to understand the many costs involved in real estate purchase before entering this active market.

This website seeks to break down these prices by offering comprehensive information on the many fees, taxes, and general costs of Dubai property, thereby providing a summary of purchasing and selling property.

Budgeting for more than the advertised price of an apartment or villa in Dubai is critical when making such a purchase. We have got the pricing data below from a renowned property marketplace in the UAE.

You may rapidly search for Dubai property on the web and use its many features to guide your choice. Usually, the whole cost of purchasing real estate in Dubai is seven to ten percent of the property value. Including many expense categories, this covers:

Preliminary Costs of Dubai Land Authority

Dubai Land Authority regulates and registers all property deals fairly. Customers who purchase property in Dubai must pay Dubai Land Department (DLD) registration fees, which include a four percent transfer tax and a part of the specific mortgage authorization cost. Paid to the buyer, these fees are set depending on the value of the property.

Real Estate Agency’s Contribution Fees

Property brokers play an important part in the Dubai property market. They assist purchasers with finding the ideal home, negotiating a fair cost, and closing the sale. They pay a fee of anywhere from two to five percent of the value of the property in return. Some developers, meanwhile, could provide residences free from real estate agency charges.

Property Registration and Title Deed Costs

Property authorization and transfer fees are one-time expenses payable to the Dubai Land Authority for the property registration in the customer’s name. The buyer is responsible for paying the charge, which is normally four thousand Dirhams, to buy property in Dubai.

Property Maintenance Fees in Dubai

Keeping a house in Dubai comes with ongoing fees related to upkeep. These fees cover common space maintenance costs like landscaping, exercise facilities, and swimming pools. Although the size, location, and amenities of the property affect maintenance expenses, generally, they charge per square foot.

Property Loan and Mortgage Costs in Dubai

If a purchaser is financing the residence with a mortgage or loan, there will be extra expenses. The buyer must pay a settlement charge to buy property in Dubai, which is normally between one and two percent of the credit value, and a valuation cost of around twenty-five hundred Dirhams. The buyer must additionally pay mortgage filing costs, which are normally a few percent of the mortgage value.

Property and Home Insurance Costs in Dubai

Property coverage is not a requirement in Dubai. However, it is suggested. Home and contents insurance protects against probable destruction or loss due to vandalism, robbery, accidents, explosions, or natural disasters. Buyers must obtain house insurance that protects the property’s structure and belongings. Insurance rates vary according to the property’s location, dimension, and value, but they normally range between fifteen hundred to five thousand Dirhams per year.

Utility Connection and Service Costs in Dubai

Property service costs are additional recurring expenses of owning a house in Dubai. These fees cover the expenses for utility bills, protection, and other facilities offered by the construction company or property management business. Service costs vary according to the property’s dimensions, location, and features, but they normally run per square foot.

VAT on Property Purchases in Dubai

Government fees and administrative costs make up a significant portion of the VAT associated with acquiring property in Dubai. VAT charged for the cost of registering the property in the new proprietor’s name is five percent, applicable according to the property value in the market.

Legal Paperwork and Administrative Costs on Property Purchases in Dubai

When acquiring a new home in the Emirates, you will incur certain administrative charges. These are divided as follows: five hundred and twenty Dirhams for the property deed, four thousand and two hundred Dirhams for DLD administration expenses, and four percent of the property value for DLD charges.

Purchasing a home is more than just making a payment and getting the house. The whole procedure, including the documentation, may be complicated to understand for the typical individual. Furthermore, people are unlikely to be aware of the regulations governing the purchase of property. Because you are spending a considerable amount of money on your purchase, it is advisable to get legal counsel to preserve your rights.

No Objection Certificate on Dubai Property Costs

Suppose the home you are buying has an underlying mortgage. The party selling the property has to get NOC from their financial institution, attesting to the payment of all dues and noting the unpaid sum. Though it’s not always the case, the seller often covers the expenses. The cost to buy property in Dubai can be five hundred to five thousand Dirhams.

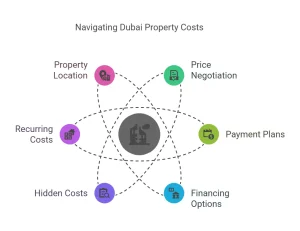

Essential Tips for Dubai Property Purchase and Cost Control

Whether you are an initial purchaser or a seasoned investor, purchasing property may be an expensive endeavor. Against the backdrop of Dubai’s property market, real estate prices may be slightly elevated. Controlling expenses is crucial to making a sound investment choice. Understanding the numerous charges associated with buying houses in Dubai is a fundamental approach to getting costs under control.

Price Negotiation and Bargaining

One of the most effective strategies for keeping prices under control when purchasing Dubai property is to negotiate the cost with the owner or developer. Buyers might hire an agent to negotiate on their behalf and receive the best possible offer for a property in Dubai.

Determine A Suitable Payment Plan

Developers in Dubai provide a choice of payment options that allow purchasers to stretch the cost of their home over a longer time. Choosing the correct payment schedule may help customers organize their cash flow and lower the upfront expenses of purchasing property in Dubai. Some developers provide flexible payment schemes that demand a smaller down payment or enable consumers to spread the payment over a longer time.

Compare Financing Alternatives

If the prospective purchaser is financing the house with a mortgage, it is essential to examine several mortgage offers to obtain the best rate. Buyers might utilize the services of a mortgage agent to analyze offers from several banks and choose the best conditions.

Be Careful of Hidden Costs

Buyers should be aware of any extra hidden costs that may be linked to purchasing property in Dubai. For instance, some developers may charge extra fees for parking spots, extra facility access, or additional services. Investors must carefully review the conditions of the contract and inquire with the developer or their property agent about any extra costs to buy property in Dubai that may apply.

Schedule For Recurring Costs

Owning a home in Dubai incurs recurring expenditures such as fees for upkeep, utilities, and insurance. Buyers should budget for these recurring fees and ensure that they possess sufficient funds to pay them.

Analyze The Position

The precise location of the property may significantly affect the expenses of purchasing and owning a home in Dubai. For example, homes in prominent locations may have better services and higher maintenance costs. Buyers should carefully examine the location and its continuing expenditures.

Conclusion

To summarize, acquiring property in Dubai may be a profitable investment, but it is important to understand the expenses associated with purchasing and maintaining property in Dubai. Buyers should be aware of the numerous fees and expenses connected with purchasing a home, including the cost of a deposit, broker fees, DLD costs, property transfer fees, mortgage expenses, upkeep costs, costs for services, and insurance.

Buyers may limit the expenses of purchasing property in Dubai by negotiating the purchase price, selecting a suitable payment schedule, comparing mortgage plans, being aware of extra fees, preparing for continuing expenditures, and carefully analyzing the location, while working with a trusted platform like Snapsale to simplify the buying process and ensure transparent, cost-effective property deals.

FAQs

Q1. What are the most common hidden fees when buying property in Dubai?

When buying your property in Dubai, look out for hidden fees. It includes parking charges, extra facility access, developer admin fees, and mortgage-related costs. It is suggested to always review contracts to avoid surprise expenses.

Q2. How much is the Dubai Land Authority registration fee?

The DLD registration fee is 4 percent of the property value. A minor admin charge is also involved. It’s the biggest upfront cost buyers should budget for.

Q3. Are there ongoing maintenance/service charges after buying in Dubai?

After buying a property in Dubai, homeowners pay service charges for upkeep of shared spaces. These are calculated per square foot. It varies by property type and location.

Q4. Do mortgage appointment or loan processing fees add to the total cost?

Yes, they add to the total cost. Mortgage processing, valuation, and settlement charges total 1–2 percent of the loan value. They can add a meaningful chunk to your purchase cost.

Q5. Is property insurance mandatory in Dubai or only recommended?

The property insurance is not mandatory in Dubai. However, it is highly recommended. Insurance protects your home and belongings against damage, theft, or accidents. Typically, premiums range from 1,500 to 5,000 in Dirhams yearly.