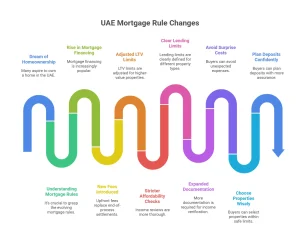

Living and buying a home in the UAE is surely a dream for many. But UAE Mortgage Rules are something you shouldn’t skip understanding. They evolve fast. In 2024 alone, over 40% of property deals involved mortgage financing. And this demand keeps rising as the UAE attracts new residents, remote workers, and global investors.

Now, these mortgage rules add another big shift, which makes buying a home smarter. There are fresh fees, new LTV limits, and a sharper focus on affordability.

If you’re planning to buy in Dubai or anywhere in the UAE this year, this guide breaks the changes into simple steps. Think of it as your clarity boost in a market that loves surprises. Ready to decode the new rules and avoid costly mistakes? Let’s dive in.

UAE Mortgage Rules in 2026

The new change in the rules refreshes how banks assess buyers and calculate borrowing power. Every update encourages responsible spending, healthier borrowing habits, and long-term financial stability.

Key changes in UAE mortgage rules 2026

- Upfront fees instead of end-of-process settlement

- Adjusted LTV structure for higher-value properties

- Stricter affordability checks with deeper income reviews

- Clear split between off-plan and ready property lending limits

- Expanded documentation requirements for income verification

Why the 2025 Mortgage Reform matters for buyers

Buyers tend to avoid surprise costs, choose properties within safe limits, and plan deposits more confidently with these rules. The changes give more clarity, reduce hidden charges, and create a transparent mortgage path.

Mortgage Rules in Dubai: Fees, LTV, and Deposits

There’s a distinctive structured approach to Dubai. Every buyer must understand these numbers before signing the agreement.

Dubai mortgage fees are now payable up front.

Banks now collect mortgage processing fees, valuation costs, and early setup charges at the start of the process instead of charging later.

How upfront fees increase the effective down payment

Below is a simple look at how upfront fees raise early cash requirements:

| Cost Component | Typical Range (AED) | Impact |

| Bank mortgage processing fee | 0.25% of loan amount | Adds to early cash-out |

| Property valuation fee | 2,500–3,500 | Paid before approval |

| DLD mortgage registration fee | 0.25% + admin | Adds to acquisition cost |

Upfront fees push your deposit higher because you pay more before the bank releases any loan amount.

Loan-to-Value limits in Dubai.

Loan-to-value LTV limits depend on property value and buyer profile. First-time buyers get higher LTV, while investors receive lower limits.

LTV examples for properties under and over AED 5M

| Buyer Type | Property Value | LTV Limit | Minimum Deposit |

| Expat | Under AED 5M | 80% | 20% |

| Expat | Over AED 5M | 70% | 30% |

| UAE National | Under AED 5M | 85% | 15% |

| UAE National | Over AED 5M | 75% | 25% |

UAE Mortgage Eligibility: Income, DBR, and Documents

Your income, monthly commitments, and spending habits determine how much the bank approves.

Salary requirement and employment criteria

Most banks require a minimum of AED 8k – 15k monthly salary, at least 6 months of employment (private sector), and 1 month for government or semi-government employees. Other than this, they need a stable income source for self-employed buyers.

Debt Burden Ratio (DBR) and affordability checks

Debt Burden Ratio helps banks understand how much of your income goes into loans. You must stay within the 50% DBR limit to qualify for a UAE mortgage.

Simple DBR calculation example for UAE mortgages

If your salary is AED 12,000 and your monthly loan commitments are AED 3,000, your DBR is:

DBR = Total Monthly Commitments ÷ Monthly Income × 100

DBR = 3,000 ÷ 12,000 × 100 = 25%

You still have room for a mortgage because you remain under the 50% cap.

Documents needed under new rules

Banks ask for Passport, visa, Emirates ID, Salary certificate, Bank statements (3–6 months), Payslips, Credit reports, Trade license (for self-employed buyers)

UAE Mortgage Rules Change for Off-Plan vs Ready Property

Buyers follow different financing paths depending on whether the property is still under construction or already handed over.

Updated financing limits for off-plan projects

Banks lower LTV for off-plan units because they carry a higher risk. Down payments usually start at 30%–40%, depending on the project and the buyer’s profile. Banks release funds in stages as construction progresses.

Mortgage rules for ready property in Dubai and other emirates

Ready property comes with higher LTV limits, faster loan approval, and quicker handover. Buyers can borrow more and pay lower deposits compared to off-plan units.

Which option suits first-time buyers in 2026

- Those who want an instant move-in and predictable cost should pick Ready Homes.

- Buyers who want lower prices and flexible payment plans but can manage a delayed handover should opt for off-plan.

2025 Mortgage Reform: Strategy Tips for Expats and Investors

The 2025 reform encourages smarter choices, better affordability planning, and careful deposit management.

How 2025 Mortgage Reform affects expat home buyers

The buyers who come from across borders handle higher upfront fees and tighter income verification as a result of mortgage rules. This ultimately provides them with clearer guidelines, predictable approvals, and safer borrowing limits.

Implications for investors and multiple mortgages

Mortgage rules affect the investor’s deal. They now face stricter LTV limits, lower caps for second homes, and stronger documentation checks. These changes promote more committed, long-term investment behaviour.

Practical steps to prepare before applying

- Maintain timely loan payments

- Clear credit card balances

- Increase savings for higher deposits

- Research banks that specialise in expat mortgages

- Prepare salary proofs and bank statements

Working with a UAE mortgage broker or advisor

The mortgage expert or Brokers help compare rates, decode fees, and choose banks that match income and DBR limits. They cut delays and simplify paperwork, which speeds up approval.

Conclusion

Knowing the UAE mortgage rules in 2026 is an unavoidable step when it comes to buying a property. It gives buyers more clarity while raising early financial expectations. New Dubai mortgage rules, upfront fees, and revised LTV limits create a more organised path for both expats and investors.

Get clarity without confusion with Snapsale. We help you understand and plan your next buy better in 2026. Snapsale helps navigate eligibility, DBR, and prepare documents early to secure a smooth mortgage journey.

FAQs

What are the latest UAE mortgage rules in 2026?

The new changes in the mortgage UAE plan ensure a more predictable and transparent process. The latest rules now focus more on upfront fees, stricter income checks, and updated LTV limits for different property values. Banks also follow tighter affordability guidelines to ensure buyers borrow safely.

How have Mortgage Rules in Dubai changed for 2026?

The mortgage fees are now being paid up front instead of later in the process. Buyers go through deeper employment and income verification. Also, LTV caps have been adjusted, especially for properties above AED 5M.

What is the minimum down payment under new UAE mortgage rules?

If the property is under AED 5M, the expats need at least 20% down. Whereas, if it’above AED 5M, 30% is required. UAE Nationals get slightly lower minimums due to higher LTV limits. Buyers must also prepare additional cash for upfront fees.

Do UAE mortgage rule changes affect off-plan properties?

It does affect off-plan units, following stricter financing limits and usually requiring higher upfront payments. Banks release funds in stages during construction, so buyers must maintain a healthy DBR throughout. These updates protect both developers and buyers.

Are expats eligible for mortgages under the new rules?

All the expats are fully eligible for the mortgage rules only if they meet income, DBR, and documentation requirements. Employment stability and a clean credit history strengthen approval chances.

How can buyers prepare for the Mortgage Reform 2025 changes?

Preparation makes the approval process smoother and faster. They can build savings, reduce debts, and organise documents early to avoid delays. Other than this, they can check DBR and compare mortgage offers to set realistic expectations.