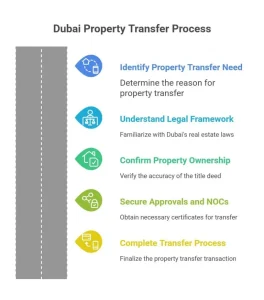

Dubai city is renowned for its thriving real estate market. An ideal market to sell a property and pass it on to a family member. Even transfer ownership for any other reason. Before tapping on, understand the process of property transfer in Dubai. Without doing so, you’ll face hurdles, and knowing it will get you a smooth transaction.

This comprehensive guide will take you through:

- The essential steps

- Important legal considerations, and

- Financial obligations

Be sure you’re fully prepared for the transfer process.

Legalities of Transfer Property Ownership in Dubai

Dubai’s real estate sector operates within a legal framework. It follows transparency and fairness in property transactions. The Dubai Land Department governs property transfers. This way, all transactions must adhere to the laws set forth by various governing bodies. This may involve the Real Estate Regulatory Agency (RERA).

You should familiarize yourself with these key regulations:

- Law No. 13 of 2008: Governs property transactions in Dubai.

- Strata Law: Applies to properties in jointly owned communities.

- Free Zone Laws: Specific rules for properties within Dubai’s free zones.

These legalities will navigate the process with confidence. Helping you avoid any potential roadblocks.

Confirm Property Ownership and Title Deeds

The title deed is the official record of Dubai property ownership. An important document for any transfer. The title deed must be accurate and up to date. Check it before proceeding with any sale or transfer. Here are a few steps you should follow:

- Get an official copy from the Dubai Land Department (DLD).

- Settle before the transfer if the property has a mortgage

- Verify that the property is free from legal issues that might hinder the transfer.

Secure Approvals and No Objection Certificates

Transferring ownership requires approvals or NOCs in some cases. This is particularly relevant for properties in gated communities. Especially in free zones or master developments. These NOCs verify that the property is free from outstanding obligations. They also validate that the transfer can proceed without any legal challenges.

NOCs may be needed from:

- Homeowners’ Associations: For properties within a community.

- Master Developers: For certain developments.

- Government Authorities: To confirm no unpaid dues or violations.

Drafting and Signing the Sale/Purchase Agreement

The sale or purchase agreement is a legal document. It outlines the terms of the transfer. This agreement will typically include:

- Sale price: The agreed-upon amount for the property.

- Payment terms: A schedule for payments.

- Transfer date: When the ownership officially changes hands.

Engage a legal expert to ensure the agreement is comprehensive. Having assistance also protects the interests of both parties.

Pay the Applicable Transfer Fees and Taxes

Dubai imposes fees when transferring property ownership. These fees are based on the property’s sale price. Must be paid before the transaction can be completed.

A detailed breakdown of the typical fees involved:

| Fee Type | Amount |

| Transfer Fee | 4% of the property sale price |

| Registration Fee | AED 580 for registration at the DLD |

| Mortgage Fees | Varies depending on the lender |

Ensure you have a clear understanding of these fees and prepare the necessary funds in advance to avoid delays.

Property Registration at the Dubai Land Department

Register the transfer when all the documents are in place. Get help from the Dubai Land Department. This is the final step in legally transferring property ownership. Parties or their representatives must appear at the DLD to complete the registration.

Documents required for Transfer Property Ownership registration:

- Sale agreement

- Title deed

- NOCs (if applicable)

- Proof of payment for fees

Upon successful registration, the DLD will issue a new title deed in the name of the buyer, officially completing the transfer.

Transfer Utilities and Service Contracts

The next task is to update utility accounts and service contracts. Ensuring the new owner is responsible for paying utility bills and other services, like maintenance fees.

Key steps to follow:

- Update water and electricity accounts: Transfer utility services to the new owner’s name.

- Homeowners’ Association (HOA) memberships: If applicable, update the membership details to reflect the new owner.

- Other service contracts: Transfer any ongoing service agreements (e.g., cleaning, maintenance).

Seek Professional Assistance When Needed

The whole Transfer Property Ownership process can be complex. This is particularly for first-time buyers or sellers. Engaging a real estate agent/legal professional can streamline the process. Meeting all legal requirements and deadlines is a must!

Real estate agents can assist with property valuation and negotiations. On the other hand, legal professionals draft agreements. Their guidance helps achieve compliance with regulations. Supporting the resolution of any disputes that may arise.

Understand Mortgage Transfers (if Applicable)

Additional steps will be required if the property being transferred has an outstanding mortgage. The mortgage lender must be notified. The mortgage must be transferred to the new owner/ fully settled before the transfer is complete.

Steps to follow:

- Coordinate with the lender: Notify the mortgage lender and follow their process for mortgage transfer.

- Clear the mortgage (if required): If the mortgage is not being transferred, ensure it is fully paid off before the property transfer.

Plan for Additional Costs and Unexpected Expenses

There may be additional costs apart from the standard fees and taxes, such as:

- Legal fees

- Agent commissions, or

- Property valuations.

Plan for these potential costs to avoid financial surprises.

Common additional costs include:

- Agent commission: Typically 2% of the property’s sale price.

- Legal fees: If you engage a lawyer for contract drafting or legal advice.

Consider the Impact of Inheritance and Estate Planning

Additional considerations if the transfer is part of an inheritance or estate planning strategy. This includes the potential tax implications and how transferring property ownership in Dubai will be handled across generations.

Seek legal advice on estate planning and inheritance laws. This helps ensure your wishes are respected and that all legal requirements are met.

Review and Maintain Documentation

Keep all transaction-related documents safe after the transfer is complete. These records, such as:

- The sale agreement

- Title deed, and

- Proof of payment

They will serve as evidence of ownership and may be required for future legal or financial matters.

Final Thoughts!

Transfer Property Ownership in Dubai can be a seamless process. Only if you follow the steps outlined and meet all requirements. Understanding the legal framework is a must. The payment of fees and taxes is another essential. Each stage requires careful attention to detail.

To sell a property, transfer it to a family member, or deal with joint ownership, for any purpose must understand these steps. The associated costs will help you avoid further complications. Take the time to plan and seek professional advice when needed. Staying informed about the latest market trends is a game-changer. This makes your property transfer in Dubai go smoothly.

FAQs for Transfer Property Ownership in Dubai

Q1. What is the process of transferring property ownership in Dubai?

The process of transferring property ownership in Dubai involves:

- Confirming title deeds

- Securing NOCs

- Drafting agreements

- Paying fees, and

- Registering with the Dubai Land Department

Q2. What fees are involved, like DLD transfer, trustee?

To transfer property ownership, you should expect to pay a 4 percent transfer fee. An AED 580 registration fee and possible mortgage charges. Moreover, extra costs like agent commission or legal fees may also be required to pay. However, it depends on your situation.

Q3. What documents are required from the buyer & seller?

The buyer and sellers are required to gather the sale agreement, title deed, NOCs, proof of fee payments, and valid IDs. Also, mortgage clearance is required if there’s an outstanding loan.

Q4. How long does ownership transfer take?

Ownership transfer through the DLD can be completed within a few days. Given that, if all documents and payments are ready. Sometimes, it takes only 24 to 48 hours.

Q5. Are there any legal or regulatory checks?

The DLD and RERA both help achieve compliance with property laws. They verify NOCs and check mortgages. They also confirm no outstanding dues before approving a smooth property transfer.